Featured

Inventory Cost Flow Methods

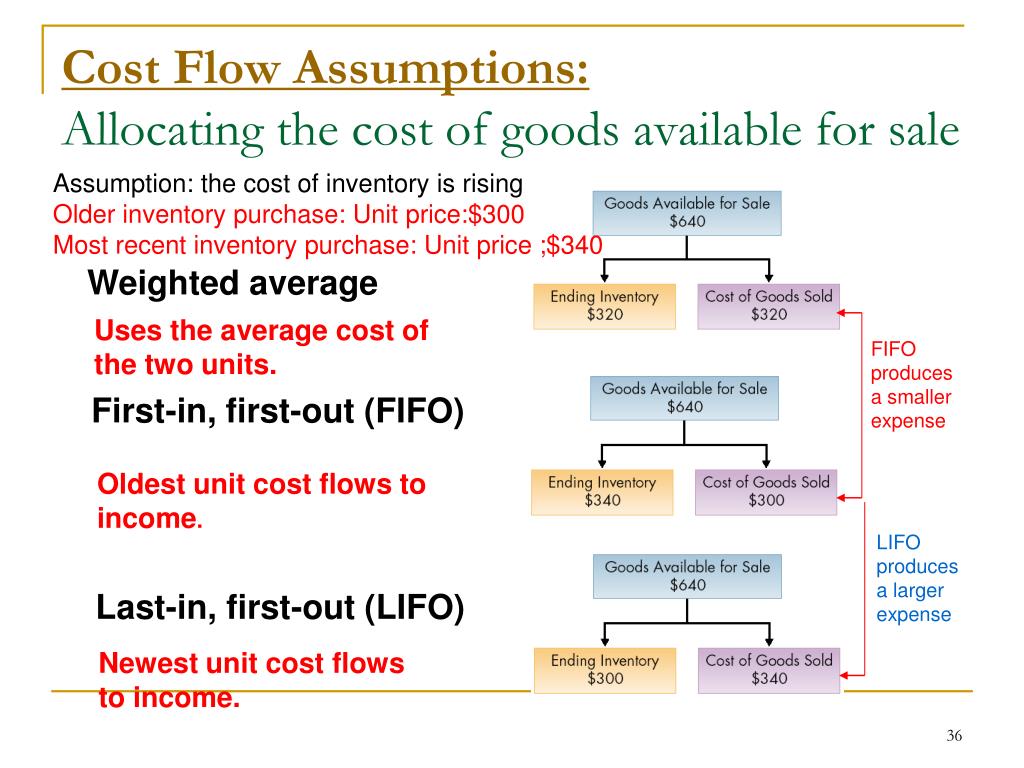

Inventory Cost Flow Methods. Or $3,985 / 1,800 = $2.21 per unit. In general, businesses buy inventory in bulk at various intervals during their accounting cycle.

The first‐in, first‐out (fifo) method assumes the first units purchased are the first to be sold. Purchased 5 oranges @ $0.20 each. 285 units at $31.24 equals $8,902 for a cost value total of $8,902.

Ifrs Allows Three Inventory Valuation Methods:

In periods of declining materials prices, the fifo method yields the same results. Additionally, there are ways to estimate ending inventory, such as the retail inventory method, and it is. The term cost flow assumptions refers to the manner in which costs are removed from a company’s inventory and are reported as the cogs.

Purchased 5 Oranges @ $0.25 Each.

Average cost is determined by dividing total cost of goods available for sale by total units available for sale. A second chart shows cost value: Under periodic inventory system, cost of goods sold is calculated at the end of period, therefore consider the latest purchase at the end of period while under perpetual inventory system, cost of goods.

First In, First Out (Fifo) Last In, First Out (Lifo) Average.

The credit entry to balance the adjustment is $13,005, which is the total amount that was recorded as purchases for the period. In other words, the last units purchased are always the ones remaining in inventory. With this, the average unit cost is multiplied by the number of soap bars sold and the balance inventory.

When Using Lifo, Use Your Beginning Inventory To Determine Your Most Recent Inventory Cost:

Examples of these assumptions include fifo, lifo and wac. Prices fluctuate so businesses will have to account for price fluctuations in their financial records. In general, businesses buy inventory in bulk at various intervals during their accounting cycle.

The Result Of This Method Will Usually Fall Between Both Fifo And The Lifo Method.

285 units at $31.24 equals $8,902 for a cost value total of $8,902. We cover inventory costs and cost flows, including what is included in the cost of inventory and how to account for inventory freight costs, inventory insurance costs, and discounts. Your most recent inventory cost is $1,050.

Comments

Post a Comment